15+ pay calculator kentucky

Kentucky Salary Paycheck Calculator. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator.

Subaru Love Promise Quantrell Subaru

The basic benefit calculation is easy it is 11923 of your base period wages.

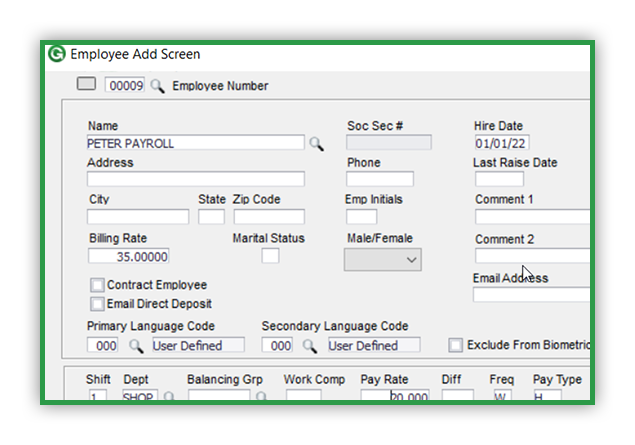

. Every first Saturday in May. Free Kentucky Payroll Tax Calculator and KY Tax Rates. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky.

Find out how much youll pay in Kentucky state income taxes given your annual income. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Kentucky Payroll Tax Rates.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Supports hourly salary income and multiple pay frequencies.

The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Living Wage Calculation for Kentucky. On the other hand if you make more than 200000 annually you will pay.

Kentucky Hourly Paycheck Calculator. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Well do the math for youall you need to do is enter.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. CINCINNATI-WILMINGTON-MAYSVILLE OH-KY-IN Print Locality Adjustment. So the tax year 2022 will start from July 01 2021 to June 30 2022.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their. However below are some factors which may affect how you would expect the calculation to. All other pay frequency inputs are assumed to.

For a detailed calculation of your pay as a GS employee in Kentucky see our General Schedule Pay Calculator. Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and. Simply enter their federal and state W-4 information as.

This free easy to use payroll calculator will calculate your take home pay. 2021 Electronic Filing and Paying Requirements. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky.

This income tax calculator can help estimate your average income. Customize using your filing status deductions exemptions and more. Important note on the salary paycheck calculator.

174 Clay Ridge Rd Alexandria Ky 41001 Realtor Com

Pdf Is Fintech Good For Bank Performance The Case Of Mobile Money In The East African Community

Tucker Station Senior Apartments 1412 Tucker Station Road Louisville Ky Apartments For Rent Rent

Kentucky Lottery Lottery Sales Representative Salaries Glassdoor

Wedding Kentucky Derby Party Winners Years Horse Race Table Etsy

Horse Boarding Budget Template For Funding Try Now

When Will Student Loan Forgiveness Programs Actually Start Paying Student Loan Hero

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

4805 E Kentucky Apartments 4805 E Kentucky Ave Denver Co Rentcafe

Kentucky State Police State Trooper Salaries Glassdoor

Hr And Payroll Software For Manufacturing Global Shop Solutions

Cane Run Station Louisville Ky Apartments For Rent

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Kentucky Paycheck Calculator Smartasset

Equestrian Kentucky Derby Table Numbers Winners Horse Race Etsy

Subaru Love Promise Quantrell Subaru

15 Happiest Cities In The United States For Software Developers To Live In

5120 Belleview Rd Petersburg Ky 41080 50 Photos Mls 607783 Movoto